Accrual basis accounting

Income and Expenditure vs Receipts and Payments

Unit 5

The Charities Commission (for England and Wales), The Office of the Scottish Charity Regulator (OSCR) and The Charity Commission for Northern Ireland require charities, including charitable incorporated organisations, to apply the Charities SORP (Statement of Recommended Practice). From 1st January 2019 this is the SORP 2019.

Regulators recognised that the usual business-type profit and loss presentation fell short of fully explaining all a charity's activities and some years ago introduced the Statement of Financial Activities (SOFA) as the major financial schedule for Charities.

The SOFA may be either on an Income and Expenditure or Receipts and Payments basis depending on circumstances.

Income and Expenditure versus Receipts and Payments

An income and expenditure report is presented on an accruals basis.

Accruals meaning

Accruals are amounts of money that have been earned or spent, but not yet paid. Accrued means that these amounts of money can increase over a period of time - accrue.

In many respects the accruals basis for reporting a charity’s financial activities is the preferred option. Accruals accounts record the income and expenditure of the charity and the increase or reduction in its assets and liabilities.

All income and charges relating to the reporting period must be considered without regard to the date of payment or receipt. Accruals accounts are compiled on a 'true and fair' basis in accordance with accounting standards.

Reporting requirements

Larger charities and those charities that are also incorporated under the Companies Act must use the accrual basis and prepare a SOFA as an Income and Expenditure report.

Smaller charities, those with income of £250,000 pa or less, are also encouraged to use the Income and Expenditure basis where it provides a reader with a better understanding of the situation of the charity. The Regulators suggest this may be where:

Donors

Donors may require accruals accounts to be prepared as a condition of a grant.

Trustees

Trustees may need to explain more about the use of their resources than simply cash movements.

- a charity has significant non-cash assets, or fixed assets which the trustees would like to value and depreciate in the accounts

- a charity has received significant non-cash donations, gifts in kind or valuable gifts of service

- a charity operates a total return policy in relation to permanent endowment investments

Growing in size and complexity

the charity, despite having an income below the £250,000 threshold, is growing in size or complexity. For example the charity may use a trading subsidiary, or the charity is involved in joint operations with other charities.

Receipts or payments from asset and investment transactions

the charity has significant receipts or payments arising from asset and investment sales and purchase, and the trustees consider that the preparation of accruals accounts would explain these transactions more clearly.

Programme related investments as equity or loan

the charity carries out its activities mainly by making programme related investments by way of equity or loan rather than by making grants to beneficiaries and the trustees consider that the preparation of accruals accounts would explain these transactions more clearly.

The Receipts and Payments basis is a relatively simple form of reporting and consists of a summary of money received and paid during the financial period. Unlike the Income and Expenditure basis there is no statutory requirements for Receipts and Payments reporting, although the Charities Regulators offer some guidance notes. As a Receipts and Payments SOFA is not prepared in accordance with accounting standards it does not necessarily offer a 'true and fair' view to the reader.

Income and Expenditure Report - Accruals Basis SOFA

The Income and Expenditure SOFA will include all items of income and expenditure and were relevant, changes in values of assets and liabilities. It is consistent with the Charities SORP 2019 (FRS102).

For any particular fund, the fund balance will be sum of all assets less liabilities allocated to the fund.

Receipts and Payments Report - Cash Basis SOFA

The report is based upon cash transactions and so will not show non-cash items such as depreciation or re-valuations. It will also not show the income from any sales invoices raised but for which a receipt had not been received in the period of the report. Supplier bills that have not yet been paid will also not show.

The Net Movement in Funds line from a Receipts and Payments SOFA will be the difference between the opening balance and closing balances for bank and cash balances and the Fund balance will be the value of closing bank and cash balances.

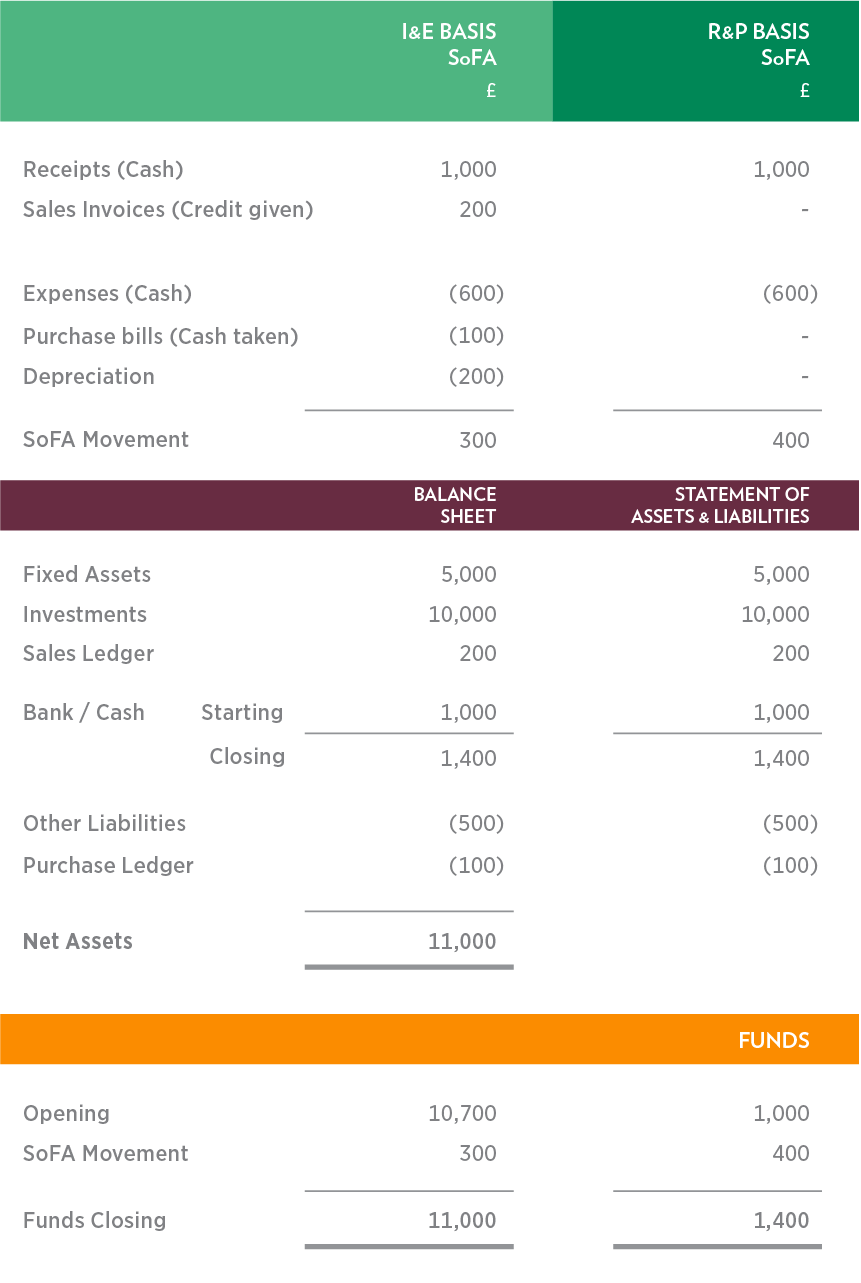

Comparing and Income and Expenditure SOFA with a Receipts and Payments SOFA

The differences between the two reports will relate to those items in the Income and Expenditure report that are of a non-cash nature. Note, if the payroll system is being used any payroll journals charging expenditure accounts are treated as cash items in the Receipts and Payments report. So things such as:

- Any Depreciation charged

- Changes in any Customer balances from the start of the accounting period to those at the end

- Changes in any Supplier balances from the start of the accounting period to those at the end

- Purchases or disposals of investments or fixed assets

- Any non-journals that have been posted to income or expenditure accounts with the exception of system payroll journals charging expenditure accounts

- Changes in the value of any other non-cash asset or liability

By inspecting the items described above a user will be able to understand the differences between an Income and Expenditure SOFA and a Receipts and Payments SOFA for the same accounting period.

By way of example the following is a simple layout. An I & E reporting charity will have a Balance Sheet in addition to the SoFA that indicates all aspects of the changes the value of assets and liabilities being reflected in Fund Balances.

LATEST NEWS

Bank reconciliation is the process of matching the balances in an entity's accounting records to the corresponding information on a bank statement. The goal is to ascertain that the amounts are consistent and accurate, identifying any discrepancies so that they can be resolved.

Understanding UK payroll is essential for businesses, self-employed individuals, and charities. It involves calculating and distributing wages, deducting taxes and contributions, and complying with HMRC regulations. Proper payroll management ensures timely, accurate employee compensation and adherence to tax and employment rules.

The Gift Aid scheme is well known in the charity sector and provides a welcome 25% boost to donation income. There is no limit to how often you can file your claim with HMRC so, if you have processes in place to be able to claim regularly.

Understanding the intricate details of the Church of England's parochial fees can be daunting. These fees, established by the General Synod and Parliament, cover a wide range of church-related services. Here's a deep dive into what these fees entail and how Liberty Accounts can streamline their accounting process for church treasurers.